What is the Debt to Equity Ratio?

The debt to equity ratio (“D/E ratio”) helps determine the financial leverage being deployed by a company. It is calculated by dividing the total liabilities of a company by its shareholders equity. It is considered an important financial metric to track as it tells us how much of a firm’s business is fueled by debt. It also indicates the stability of a firm and evaluates its ability to raise additional capital in the future.

Key Takeaways

- The debt to equity ratio is a measure of a firm’s financial leverage

- It is a metric which tell us the amount of debt and equity being used to finance a company’s assets

- When a company takes on significant debt to fund its operations, it is considered highly leveraged. Highly leveraged firms will have a higher debt to equity ratio as compared with firms who deploy lesser amounts of leverage.

- It can be difficult to compare debt to equity ratios across industries as capex requirements vary significantly, hence affecting the total amount of capital required to continue operations.

Debt to Equity Ratio Formula

The Debt to Equity Ratio is calculated using the following formula:

Debt to Equity Ratio = Total Liabilities / Shareholder’s Equity

- Total Liabilities represent all of a company’s debt and the following items should be considered in the calculation: Long term debt, current portion of long-term debt, notes payable, drawn lines of credit, bonds payable and capital lease obligations. We must incorporate all sources of debt which are being used to carry out operations of the firm

- Shareholder’s Equity is defined as the owners’ residual claim on assets after all debts have been repaid. In other words, Shareholder’s Equity is equal to a firm’s Total Assets minus its Total Liabilities

How to Calculate the Debt to Equity Ratio from a Balance Sheet

Let’s take an example of the U.S. airline industry, which is a capital-intensive business. We say capital intensive because airlines have to purchase aircrafts, retrofit them, pay for fuel as well as rent for hangars, repairs etc. The airline business is a service business that uses earnings it generates to repay its debt. In addition, the airline business is a seasonal business. This seasonality also makes it difficult for them to ensure that they are always able to service their debt obligations.

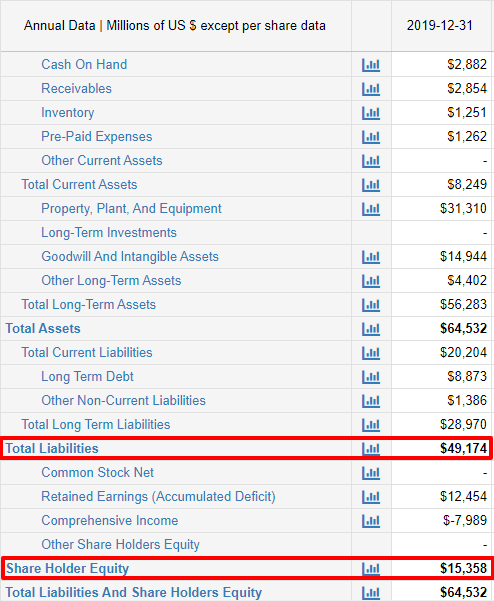

Suppose we wanted to calculate the debt to equity ratio for Delta Airlines (DAL), whose balance sheet (as of Dec. 31, 2019) is shown here:

For total liabilities, which is our numerator in the debt to equity ratio formula, we have considered total liabilities, used to fund operations. For the airlines industry, which leases a lot of its aircrafts instead of buying them, liabilities will be much larger than in some other industries.

For Delta, the debt to equity ratio for 2019 can be computed as follows:

Delta Debt to Equity Ratio = $49,174B / 15.358B = 3.2x

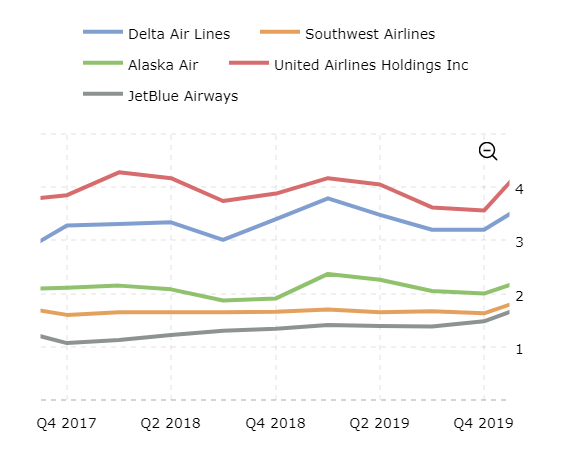

So, let us now calculate the debt to equity ratio for Delta’s peers in order to see where Delta lies on the scale. The debt to equity ratio as at Dec.31, 2019 for Delta’s competition is shown in the chart below:

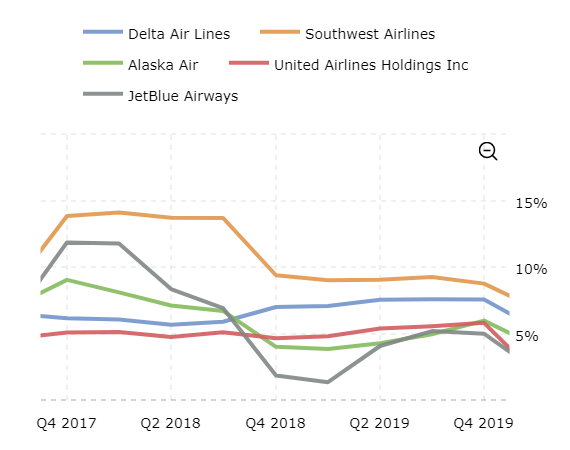

We can see that Delta is not the most leveraged airline in the sector. So, can we interpret the high debt to equity ratio for United Airlines as a good thing and the low debt to equity ratio for Southwest as a bad thing? It would be difficult without referencing data from another metric. Now that we know how much debt these firms are using to fund their assets and operations, let us find out how effectively its investments are paying off. So, let us now compare the return on assets (“ROA”) for these firms. We have calculated the 2019 ROA for the airlines and the results are shown below:

We can observe that Southwest Airlines has the highest ROA amongst peers. This means they are the most efficient when it comes to generating returns from their assets. Not only that, Southwest has done so without taking on significant debt, as is evident from its low debt to equity ratio.

Let us also examine the situation with United Airlines. This firm has deployed a lot of debt (highest in the sector) but is only able to generate below average ROA. This could be a sign of distress for some analysts as the interpretation is that even with adequate availability of funds, the company is significantly underperforming its peers.

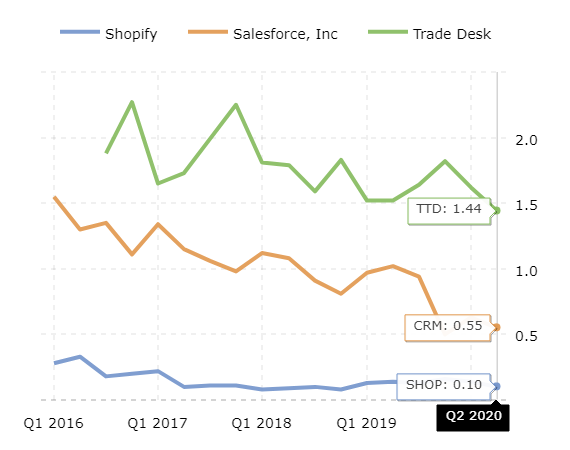

To prove the concept that less capital-intensive companies usually have lower debt to equity ratios, let us take a look into the debt to equity ratios for some of them. Below we compare the debt to equity ratios for technology companies developing application software.

As we can clearly see from the above graph, software developers have a significantly lower debt to equity ratio on average. This is simply because technology companies do not have to establish huge factories and worry about manufacturing. Since their business is completely online, they have little to no inventory. Also, for software companies, once their technology solution is developed, it can be instantaneously distributed around the world. The only cost to these companies is investing in R&D to make their service offerings even more competitive.

What is a Good Debt to Equity Ratio?

The optimal debt to equity ratio will vary widely across industries, given that some are more capital intensive than others. So for example, for technology stocks, the general consensus is that it should not exceed a level of 2x. Larger corporations in fixed asset-heavy industries, such as mining or manufacturing, may yield ratios in the range of 2x to 5x. Ratios more than 5x should make investors nervous and case them to re-examine the investment opportunity thoroughly, especially the ability to generate cashflows for the foreseeable future.

When evaluating the financial health of a company, it is particularly important to pay attention to the debt to equity ratio. If the ratio is rising, the company is being financed through debt rather than from its equity sources. This might be a dangerous trend since creditors and investors usually prefer lower debt loads since their potential downside is better protected in the event of a downturn in the economy.

A high debt to equity ratio usually means that a firm has been aggressive in financing its growth through debt funding. This can result in volatile earnings given the burden of the additional interest payments.

If a significant amount of debt is used to expand operations, the firm could potentially generate more earnings than it would have without this debt financing. If these expenditures were to drive top line and increase earnings by a larger amount than the cost of the debt (interest payments), then the shareholders benefit as now there are more earnings available for the same number of shareholders. However, it is important to note that the cost of this debt financing may outweigh the return that the company generates and may become too much for the company to handle. In a bad economy, a firm might find it difficult to keep up with interest payments and this will eventually lead to bankruptcy, which would leave shareholders holding the bag.

An optimal debt to equity ratio is considered to be ~1, i.e. when liabilities are equal to equity, but as explained above, the ratio is very industry specific since it depends on the proportion of current and non-current assets. The more non-current assets a firm deploys, as is the case with capital-intensive industries, the more equity is required to finance those assets.

Factors Affecting the Debt to Equity Ratio

Below we list out a few different business scenarios which should be kept in mind when evaluating a company’s merits.

| Business Predictability | Low debt to equity ratios are more suitable for companies that operate in volatile and unpredictable environments. The reason for this is that they would not be able to make interest payments on their obligations in case of a downturn in the economy |

| Collateral Availability | Access to assets held for long-term use may increase a firm’s appetite to sustain a higher debt to equity ratio since it can offer better security to creditors in the event of a default. On the other hand, when most assets are held for the short term (i.e. inventory), the organization’s appetite to sustain a higher debt to equity ratio is significantly reduced because such assets offer lesser degree of safety to creditors in the event of a default |

| Interest Coverage | A healthy interest coverage ratio tells us that more borrowings can be obtained without taking excessive risk and vice-versa. Companies which are able to generate consistent cash flows can afford to sustain a higher debt to equity ratio compared with peers who are not |

| Contractual Obligations | Regulatory and contractual obligations should always be kept in mind when considering increasing debt financing. In order to reduce the risk of bad loans, banks will sometimes impose restrictions on the maximum debt to equity ratio of borrowers as defined in the debt covenants in the loan agreements |

Interpreting the Debt to Equity Ratio

A high debt to equity ratio tells us that a firm is using more debt to finance its growth compared to equity. Firms that deploy large amounts of capital in assets and operations often have a higher debt to equity ratio. A higher ratio means a riskier investment given that the business might not be able to generate enough cash flow to repay its creditors.

A high debt to equity ratio can be good if a firm is able to generate enough cash flow to ensure interest payments. It tells us that it is using the leverage effectively to increase equity returns. Another benefit is that typically the cost of debt is lower than the cost of equity. Therefore, increasing the debt to equity ratio (up to a certain limit) can help lower a firm’s weighted average cost of capital (WACC).

On the other hand, If the debt to equity ratio is lower, we can ascertain that the firm has not relied on external debt borrowings to fund operations. It is important to note that investors would not likely invest in a firm with an extremely low debt to equity ratio as this could imply that the firm is not realizing its full profit potential.

The debt to equity ratio tells us the degree of indebtedness of an enterprise and gives an idea to the long-term lender regarding extent of security of the debt. As indicated earlier, a low debt to equity ratio reflects more security for creditors. A high ratio, on the other hand, is considered risky as it may put the firm into difficulty in meeting its obligations to lenders. However, from the point of view of the owners, greater use of debt may help in amplifying returns if the rate of earnings on capital employed is higher than the rate of interest it pays on its debt.

Negative debt to equity ratio

A negative debt to equity ratio occurs when a company’s interest payments on its debt obligations exceeds its return on investment. A negative debt to equity ratio can also be a result of a firm with a negative net worth. Companies with a negative debt to equity ratio are often viewed as extremely risky by analysts and investors given that this is a strong sign of financial instability.

Reasons for a Negative debt to equity ratio

A company could have a negative debt to equity ratio for a variety of reasons. We list out some of them below:

- Utilizing additional debt to cover losses instead of issuing equity

- Making large dividend payments that exceed shareholders’ equity

- Experiencing financial loss in periods following large dividend payments

If any of these situations were to appear, it could signal financial distress for all stakeholders.